As temperatures climb to 50 °C in summer and annual rainfall stays under 200 mm, supplying the population with safe drinking water

Continue reading

Dubai

As temperatures climb to 50 °C in summer and annual rainfall stays under 200 mm, supplying the population with safe drinking water

Continue reading

Apartment deep cleaning services in Dubai go beyond regular cleaning to provide a healthy, allergen-free environment. This guide explains the importance of deep cleaning, from tackling hidden dust to creating a hygienic space that promotes well-being.

Continue reading

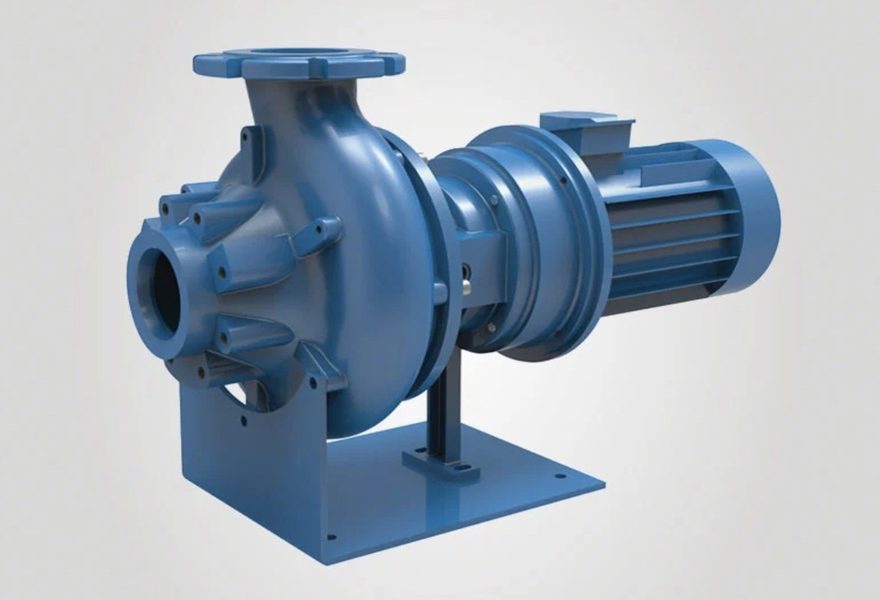

Centrifugal pumps are widely used in industries for moving liquids efficiently. They work by spinning an impeller to create pressure, pushing liquids through the system. Made from materials like cast iron and stainless steel, they handle various fluids, even those with particles, reliably.

Continue reading

JUUL Pods provide a simple, effective solution for ex-smokers moving to vaping. With smooth nicotine delivery and a compact design, JUUL Pods are designed to replicate the familiarity of smoking, making them an excellent option for former smokers in Dubai.

Continue reading

Embark on an unforgettable Australian road trip with a Mitsubishi rental. Explore iconic routes like the Great Ocean Road and the Savannah Way, uncover breathtaking landscapes, and visit top destinations.

Continue reading

Curious about the evolution of spa culture in Dubai? Explore the journey from traditional hammams to luxurious modern spas. Understand how Dubai has become a global hub for wellness and relaxation, combining ancient practices with cutting-edge technology.

Continue reading

Elevate your shisha indulgence in 2023 with our comprehensive guide, packed with expert tips for flavor mixing and exciting activities that will make every session an unforgettable experience. Don’t settle for the ordinary, transform your shisha smoking with our guide.

Continue reading

This article discusses dermatitis in cats, detailing its symptoms, causes, diagnostic methods, and treatment options, including pharmacologic drugs and diets. For expert care in Dubai, check out Vets in the City for the best pet clinic to treat cat dermatologic problems.

Continue reading

From a pearl diving base to a futuristic metropolis, Dubai demonstrates visionary urban planning and innovation. Landmarks such as Dubai Frame and Palm Jumeirah exemplify a luxury lifestyle. Explore Dubai with Al Mizan Car Rental, where historical wealth meets modern glamour.

Continue reading

Delve into the world of clay paint restoration and gain insights into how this technique can bring out the best in your vehicle’s finish. Discover the benefits and steps involved in achieving a flawless, polished look for your car.

Continue reading

In the fast-paced world of retail, first impressions matter more than ever. A potential customer only takes a few seconds to form an opinion about your store. That’s why maintaining a clean and inviting retail space is crucial for success. In this blog post, we’ll explore the importance of retail store cleaning services and how they can transform your business.

Continue reading

The company should reward back, but if, due to past problems, the company loses healthy relationships with its employees, it should be fixed as soon as possible. How can you do that? This article discusses exactly that so you know how to proceed.

Continue reading